One of the key business strategies that organizations across industries bank on for sustained growth is financial analytics. An advanced financial analytics engine can unearth powerful insights for better business decisions. This article will focus on how financial analytics empowers businesses at every growth stage.

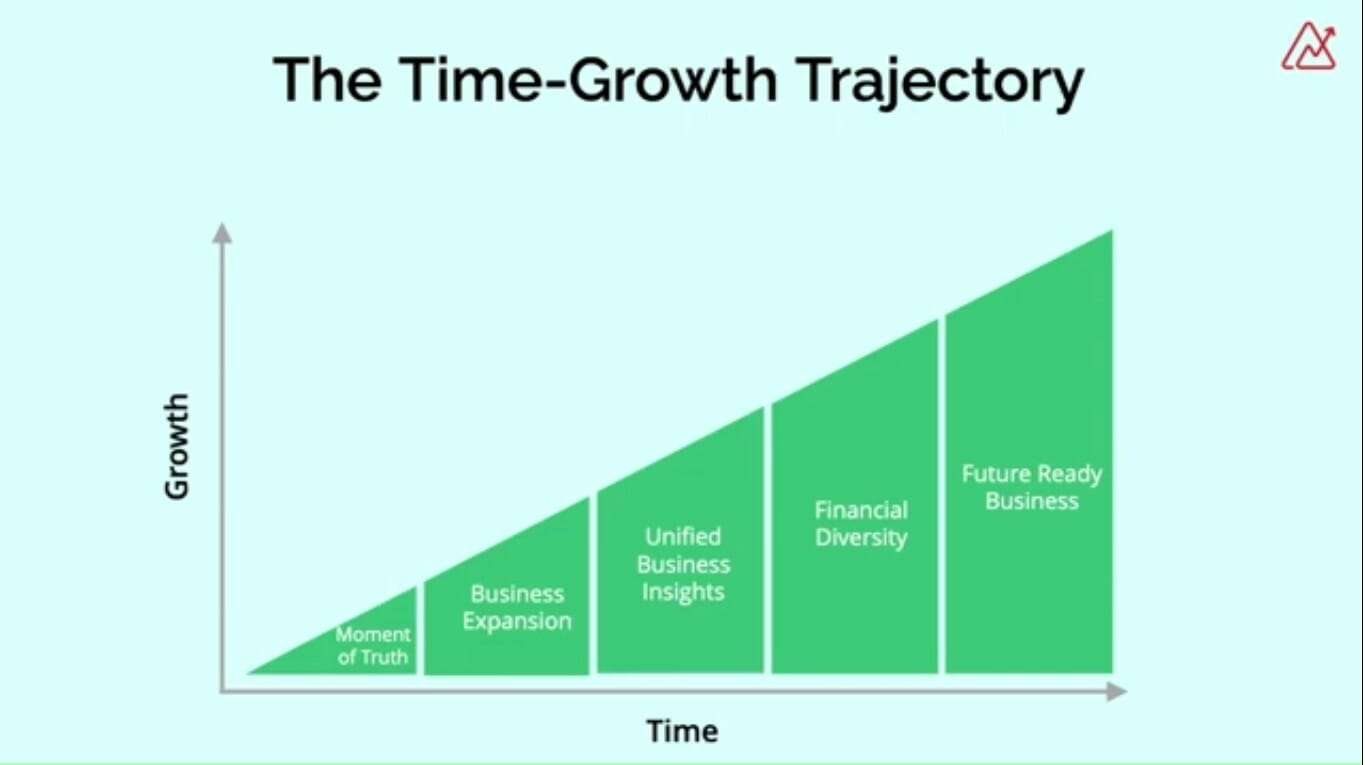

Time Growth Trajectory

The time growth trajectory is a powerful framework that can help businesses identify the growth stage and then map their financial analytics strategy. This framework breaks down a business’s journey into five stages and maps it against growth and time. It starts with a moment of truth where the business gears up for growth. The second stage of the time growth trajectory is a business expansion where the company geographically expands or moves into a different line of business or allied businesses. The third stage of the time growth trajectory is the need for businesses to have unified business insights. This is all about having end-to-end financial insights for the business. This is followed by financial diversity, where the organization undergoes a paradigm shift in its financial outlook, and to take it forward, businesses become future-ready. These are the five different stages of the time growth trajectory.

How Financial Analytics Is Powering Business Growth

Taka business that’s into servicing cars, for example, we will learn how financial analytics is augmenting its growth in each of these five stages.

Moment of Truth

I want to call it growth at escape velocity. This means that these are the essential activities a business has to do to gear it up for growth. How do you do that? You might line up your resources, get more people into the business, or start streamlining your processes. Essentially, it’s about giving an overall to your entire organization. Businesses need to go beyond traditional finance. It’s important to start focusing on business insights. It would help if you had a granular understanding of your business and specifically on finance. If you want to do that, your traditional finance may not be able to give you the right kind of business insights that you need to gear up for growth.

What do you do then? That’s where you establish a financial ecosystem inside your organization. This would be the first step in the time growth to gear up your businesses for the future. And with that in place, you’re able to drive your organization with powerful business insights and financial insights.

To help you build this robust financial ecosystem, you need a couple of business enablers: Zoho analytics and Zoho books.

The Time Growth Trajectory

After the business has had its moment of truth, the business starts to expand. The business gets into different cities, towns, and countries, or the business gets allied or starts a new line of business.

For this example, we have considered a company that’s into servicing cars, and let’s assume that they have launched two new businesses, which are selling new cars and pre-owned cars? This means you have three business entities to be managed now. Your system has to handle the growing complexities within your business. It’s important to have a holistic assessment of your business. It can enable you to perform a cross-impact analysis that translates to how the variables of one particular business impact the other business or the entire organization.

Unified Business Insights

Now that our business has had its moment of truth, and it has made its first expansion to cater to the growing business needs, this company that’s into servicing expands its sales teams, adds more employees, beefs up its inventory, and does a lot of other things.

What does this mean for your business? It means your business is now going to run on multiple businesses. Your businesses might have operated on one or two business applications when you are a single entity. Today, the business has grown; businesses need to have unified business insights at this stage in the time growth trajectory. And why is that because of the adoption of multiple business applications?

How is this being and at an organizational level? Companies deploy ad-hoc applications, which are essentially multiple unconnected sources or applications with little or no interaction. When such an ecosystem is deployed, you begin to create data and analytics silos. It leads to the self-styled interpretation of insights, and business efforts are localized or regionalized at a team level, leading to a lack of clarity on the business’s financial health. You need a system that can give you n to end financial insights. No department or function inside a business operates in isolation; every department is connected and depends on each other’s performance.

Financial Diversity

At this stage, businesses undergo a paradigm shift in their financial outlook. It’s no more the traditional way of looking at finance, and it’s going to be a completely different approach towards finance altogether. Businesses are moving from a unilateral approach toward profit to a more diverse approach. Businesses can discover new KPIs using financial analytics and use them as jet boats to propel profit. Traditionally profit is viewed as sales minus expenses where you have two possibilities of increasing your profit. First, you increase your sales, thereby increasing profit or reducing your expenses and increase profit. We encourage businesses to look at KPIs from multiple dimensions in financial diversity. Let’s say you want to have profit. Don’t just stop with sales minus expenses, but analyze profit by region, invoice, profit, and salesperson. By doing so, you are adding a layer of granularity to profit or any other financial metric. This helps you to rebalance your business efforts to increase profits.

Future-Ready Business

Getting your business future-ready from a financial perspective means democratizing financial analytics. This means you’re making it available for a larger group of people within your organization. Why is that important? In addition to performing outcome analysis (on completing a business activity. You measure the effectiveness of that particular activity), businesses are also adopting checkpoint analysis. Let’s say you define a business goal a. You’ve set up five or six checkpoints to ensure that multiple stakeholders involved in achieving this business goal a are empowered at every checkpoint to ensure they are well aligned towards your business goals. Empowering your stakeholders with financial insights is a key way of gearing up your business for the future. If you find out how your kids will be and how all your finances will be for the next few months, you’ll be in a better position to plan your business activities. As leaders, it’s important to nurture a culture of collaboration among your teams to sustain these various initiatives that you will now set in your company.