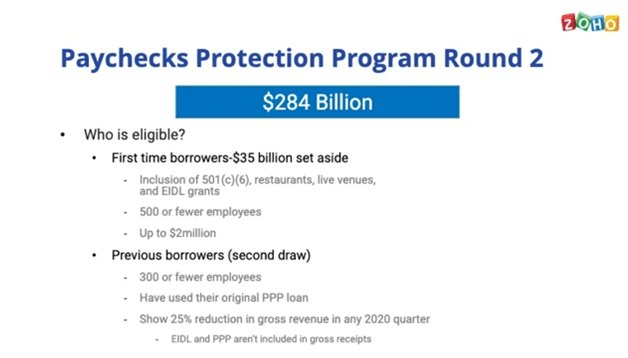

The PPP loan forgiveness program was launched to help small businesses. Talking about the 900 billion in covid-19 relief fund. The main area that small businesses need to focus on is the top three. There’s 325 billion and aid for small businesses, including the second round for PPP and also 160 billion for economic impact payments and 120 billion and unemployment benefits with three hundred dollars per week for 11 weeks. For the Paycheck Protection Program (PPP) round 2, there will be a dedicated 284 billion for the PPP.

For First time borrowers, there is set aside 35 billion. To qualify, you need to have 500 or fewer employees, and the loan is up to two million dollars compared to the first PPP, which was 10 million.

For previous borrowers, though, they changed the criteria a little bit compared to first-time borrowers. You need to have 300 or fewer employees, compared to the 500 for first-timers. And you have to have used up the original PPP loan completely, and you need to show a 25 percent reduction in growth revenue for any quarter in 2020.

It comes down to whether your accounting is up to date. You need to keep track of all that, and definitely, since the year is coming to a close, it is advisable to finish up your fourth quarter as soon as possible. So, you can apply for this loan whenever it becomes available.

PPP Round Two Loan

The PPP round two loan terms are quite similar to the previous one. Except for the loan amount being reduced to 2 million compared to 10 million in the previous round. The loan amount is 2.5 times your average total monthly payroll. However, for hotels and food services, they are eligible to 3.5 times the average total monthly payroll.

The cost allocation is still the same. Sixty percent towards payroll, and forty percent towards business expenses, for the same coverage period, which is between 8 or 24 weeks, and same covered costs, including payroll, mortgages interest, rent, and utilities.

However, an additional cover cost was included in the second round of PPP loans to include protection and facility modification; additionally, software and Cloud Computing Services have been added to the list. Basically, anything you need to keep your moving business forward is now considered as a cover cost.

Tax Deductibility

the new Covid19 relief bill clarifies that no deduction shall be denied. No, tax attribute shall be reduced, and no basis increase shall be denied by reason of the excluded exclusion from gross income provided. Whatever you use to claim forgiveness, mortgage payments, all of your payroll, all these when filling tax return can be deducted from the normal.

How Forgiveness Works

The allowable costs are payroll costs, rent interests on mortgages, and skill expenses. And the Forgiveness ratio is 60/40 for the covered period. Kind of we, you know, we’ve been talking about this a little bit, is 8 or 24 weeks and no later than December 31st, 2020.

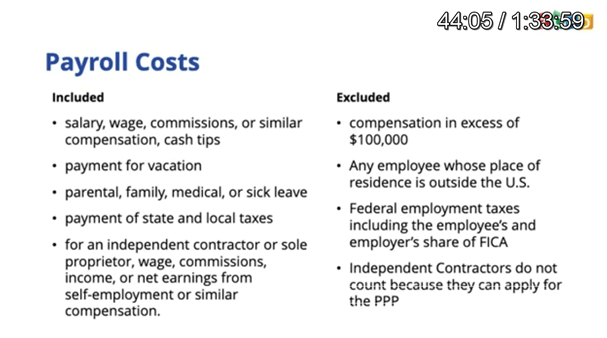

What’s included in the payroll cost that so

- Salary wage commissions or similar compensation and cash tips.

- Payment for vacation.

- Parent, family, medical or sick leave.

- Payment of state and local taxes.

- For an independent contractor or sole proprietor, wages, commissions, income, or net earnings from similar employment or similar compensation.

What’s excluded?

- Compensation in excess of 100,000 dollars.

- Any employee who makes over a hundred thousand dollars has to adjust to that to get that 2.5 times.

- An employee whose place of residency is outside the US.

- The US federal employment taxes, including the employees and employers, share a FICA.

- Independent contractors do not count because they can apply for a PPP loan.

- Non-Payroll Cost.

- Business mortgage interest payments.

- Business rent or lease payments and business, utility payment.

- Anything to protect you or your customers is included and anything that keeps your business afloat during the pandemic.

Forgiveness Reduction

Your forgiveness will be reduced if salary or wages are reduced by 25%. And if your full-time equivalents are not mandated during the cover period. There are some safe harbors, though; there’s no need to rehire if the employer rejects the job offer and also if the workers are rehired within a certain period as well.

Criteria for Forgiveness Reduction

Your PPP loan forgiveness can be reduced based on the following. If you get, for example, 50,000 for your employees and the payroll for them gets reduced by 25%, Then it’s just going to trickle down.

- If your PPP Loan isn’t forgiven, there is an interest rate of 1%

- loans issued prior to June 5th have a maturity of two years, and loans issued after June 5th have a maturity of five years.

- The loan payments will be deferred for borrowers who apply for the loan forgiveness until SBA remiss borrowers’ loans. Forgiveness amount to the lender. If a borrower does not apply for a loan, forgiveness payments are deferred ten months after the end of the cover period for the borrower’s loan. Forgiveness.

- No Collateral or personal guarantees are required.

- Neither government nor lender will charge small businesses any fees.

Loan Forgiveness Application

The loan forgiveness applications forms are 3508, 3508EZ, and 3508S. The 3508 is the regular form, the 3508EZ, is for self-employed or employers, meaning one of the safe harbors, and then form 3508S-PPP are for loans less 50,000.

What you need to for these forms is you need your payroll information. You can get that from your bank account statements, payroll reports documents from a payroll provider, or if you’re using accounting software, you can get it from there as well.

- You need your tax forms; go ahead and get both federal and state 941 and 940.

- You also need your FTE information.

- The average number of FTE employees on payroll per week employed by the bar between February 15th, 2019, and June 30th, 2019. Or January 1st, 2020, in February 29th, 2020.